All Categories

Featured

Table of Contents

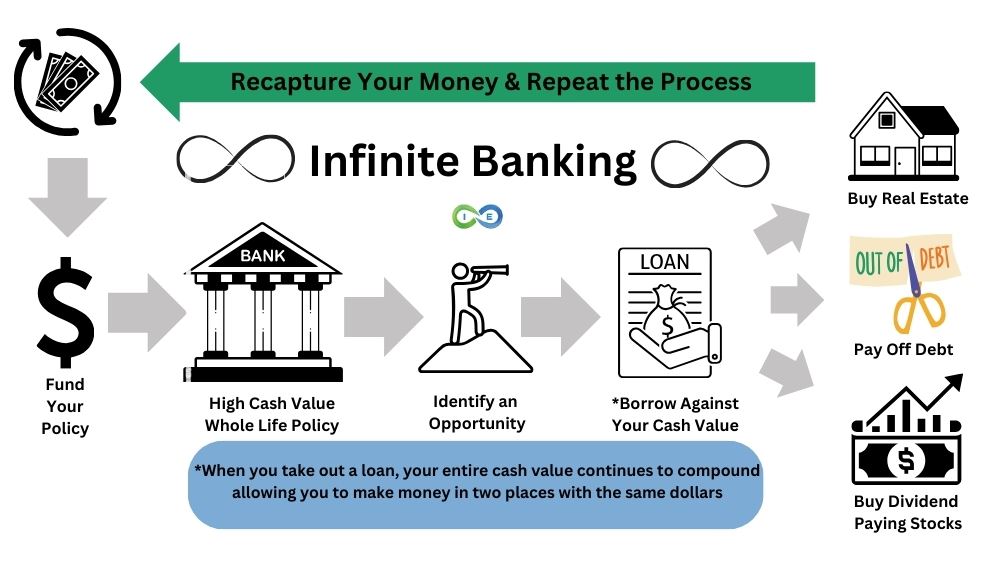

Using the above instance, when you get that exact same $5,000 financing, you'll earn returns on the whole $100,000. It's still completely moneyed in the eyes of the mutual life insurance policy company. For boundless financial, non-direct acknowledgment policy car loans are ideal. It's important that your policy is a combined, over-funded, and high-cash value plan.

Motorcyclists are extra attributes and advantages that can be included to your plan for your details needs. They allow the insurance holder purchase extra insurance coverage or change the problems of future acquisitions. One factor you may wish to do this is to plan for unanticipated illness as you obtain older.

If you throw in an added $10,000 or $20,000 upfront, you'll have that cash to the bank from the beginning. These are simply some steps to take and think about when establishing up your way of living banking system. There are numerous different methods which you can take advantage of lifestyle banking, and we can aid you find te best for you.

Scb Priority Banking Visa Infinite

When it concerns economic preparation, whole life insurance usually stands apart as a popular choice. There's been a growing pattern of marketing it as a device for "unlimited banking (infinite banking)." If you have actually been exploring entire life insurance policy or have come throughout this concept, you might have been informed that it can be a means to "become your very own bank." While the concept may seem attractive, it's crucial to dig deeper to understand what this really suggests and why watching entire life insurance coverage in this method can be deceptive.

The idea of "being your own bank" is appealing due to the fact that it suggests a high degree of control over your funds. Nevertheless, this control can be imaginary. Insurer have the utmost say in how your policy is handled, including the terms of the lendings and the rates of return on your cash money value.

If you're thinking about whole life insurance policy, it's important to view it in a broader context. Whole life insurance policy can be a valuable tool for estate preparation, providing an ensured death advantage to your beneficiaries and potentially offering tax obligation advantages. It can likewise be a forced financial savings car for those that have a hard time to save money continually.

It's a kind of insurance coverage with a financial savings part. While it can offer consistent, low-risk development of cash value, the returns are normally less than what you may attain through other financial investment automobiles. Before delving into whole life insurance policy with the idea of infinite banking in mind, take the time to consider your financial objectives, risk resistance, and the complete series of economic items offered to you.

Limitless financial is not a monetary panacea. While it can operate in specific scenarios, it's not without dangers, and it requires a significant dedication and comprehending to take care of successfully. By recognizing the prospective mistakes and comprehending truth nature of entire life insurance policy, you'll be much better equipped to make an educated choice that sustains your economic well-being.

Instead of paying financial institutions for things we need, like automobiles, homes, and institution, we can invest in means to keep even more of our cash for ourselves. Infinite Financial method takes an innovative strategy towards individual finance. The technique essentially includes becoming your very own financial institution by using a dividend-paying entire life insurance policy plan as your financial institution.

Rbc Visa Infinite Private Banking Card

It supplies considerable growth with time, transforming the conventional life insurance policy into a tough financial device. While life insurance policy companies and banks take the chance of with the variation of the market, the negates these dangers. Leveraging a cash worth life insurance policy plan, people appreciate the advantages of assured development and a fatality benefit secured from market volatility.

The Infinite Financial Concept shows just how much wide range is completely transferred away from your Family or Business. Nelson likewise takes place to clarify that "you finance everything you buyyou either pay passion to somebody else or offer up the passion you can have otherwise made". The real power of The Infinite Financial Concept is that it solves for this trouble and encourages the Canadians that accept this principle to take the control back over their financing needs, and to have that cash streaming back to them versus away.

This is called shed possibility cost. When you pay cash for points, you permanently quit the possibility to earn passion by yourself financial savings over multiple generations. To address this trouble, Nelson created his own banking system through the use of reward paying getting involved whole life insurance policy plans, preferably via a common life company.

Because of this, insurance holders need to carefully review their economic objectives and timelines before choosing this technique. Sign up for our Infinite Financial Training Course. Regain the passion that you pay to banks and financing firms for the significant things that you need during a life time. Build and maintain your Individual/ Company wide range without Bay Street or Wall Street.

Rbc Private Banking Visa Infinite Card

Keep in mind, The infinite Banking Concept is a process and it can radically enhance every little thing that you are already carrying out in your present financial life. Exactly how to get undisturbed COMPOUNDING on the regular payments you make to your cost savings, reserve, and retirement accounts Just how to place your hard-earned money to ensure that you will certainly never have one more sleepless evening fretted about just how the marketplaces are going to react to the next unfiltered Governmental TWEET or worldwide pandemic that your household just can not recoup from How to pay yourself first using the core principles instructed by Nelson Nash and win at the money game in your very own life Exactly how you can from third event banks and loan providers and relocate it right into your own system under your control A structured method to see to it you hand down your wide range the way you want on a tax-free basis Exactly how you can move your cash from for life strained accounts and shift them into Never ever exhausted accounts: Hear exactly just how people similar to you can implement this system in their own lives and the impact of placing it into action! That creating your very own "Infinite Financial System" or "Riches System" is perhaps the most amazing technique to shop and secure your capital in the country How carrying out The Infinite Financial Process can create a generation causal sequence and teach true stewardship of money for numerous generations Just how to be in the driver's seat of your financial destiny and lastly create that is secured and only goes one directionUP! The duration for developing and making considerable gains through limitless financial greatly relies on numerous factors distinct to an individual's financial placement and the policies of the monetary establishment providing the service.

A yearly returns payment is an additional massive benefit of Limitless financial, more stressing its good looks to those tailored in the direction of long-term monetary development. This method calls for mindful consideration of life insurance policy expenses and the analysis of life insurance quotes. It's important to examine your credit scores report and confront any kind of existing charge card financial obligation to ensure that you remain in a desirable placement to take on the method.

A key element of this approach is that there is insensitivity to market variations, as a result of the nature of the non-direct acknowledgment lendings used. Unlike financial investments linked to the volatility of the markets, the returns in limitless banking are steady and foreseeable. Additional cash over and above the premium repayments can additionally be included to speed up development.

Be My Own Banker

Insurance holders make regular costs payments right into their participating whole life insurance policy to maintain it effective and to construct the policy's overall cash worth. These premium settlements are usually structured to be regular and predictable, making certain that the plan remains active and the cash money value remains to expand gradually.

The life insurance coverage policy is designed to cover the whole life of a specific, and not simply to assist their beneficiaries when the individual dies. That said, the policy is taking part, meaning the plan owner ends up being a part proprietor of the life insurance policy company, and takes part in the divisible earnings produced in the type of dividends.

"Here comes Revenue Canada". That is not the situation. When returns are chunked back into the plan to buy compensated enhancements for no extra price, there is no taxable event. And each paid up enhancement additionally receives dividends every year they're proclaimed. Now you may have heard that "returns are not ensured".

Latest Posts

Bank On Yourself Whole Life Insurance

Infinite Credit Loan

Bank On Yourself Problems